Financial Planning: 7 Not-So-Famous, But Thought-Provoking Facts

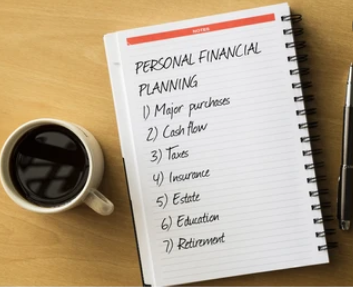

What comes to mind when you hear financial planning? Most people can relate to financial management by using math and money.

However, managing money is more than that. Financial planning used to be about saving for retirement or securing one’s future. But let's now look at a different way of managing money. These 7 observations will help us to understand the new perspective.

1. Your future is important, but so is your present

Everything happens in the moment and for the moment. Although it sounds philosophical, it is actually true.

Any goal can be achieved if you focus on the present and not the future. Future is an illusion, which cannot be predicted. You can design your future as an investor by creating a financial plan. Planning your finances is like planning your life.

While most investors believe that financial planning is going to help them secure the future, it will actually help them learn how to play fully in the present. Instead of worrying about the future, think about what you can do now with your financial resources.

2. A long, complicated financial plan document is just a myth

What's the purpose of a financial plan? To help us take control of our finances. Long plans can only confuse clients. Investors will become increasingly frustrated if they are presented with lengthy financial plans that include complex calculations, pie charts, and heavy graphs.

Instead, you might consider getting a financial program that you can implement as an investor. It may be a summary or one-page document, which is easy to read and understand.

A short plan is more specific and focuses on the most important matters that are relevant to clients. This plan will help you understand your financial life.

3. Look for a flexible financial plan

An agile financial plan is one that follows the financial planning process in a systematic way. As many as 80% of people who receive a personalized financial plan from a financial planner follow it only partially. They don't have any enthusiasm for their plan.

Only 20% of people are able implement financial planning advice successfully, which means that their family has a great financial future.

Financial planning is not about exchanging advice and ideas. The rest of the work is about taking action.

It is hard to give a verdict on any plan without taking action. You can do it!

For the majority of the 80%, however, financial planning can be a burden. This hack shouldn't affect your financial life.

A planning tool is only trusted by investors if it takes action. It is the activities that result that are important. That's all.

4. Your financial plan is only about YOU

When looking for a financial adviser, what should an investor consider? Find a financial advisor who can help you get the best investment returns. Financial planning is not about calculating returns and products. It is all about you.

Each person's financial plan should be tailored to suit their lifestyle and needs. A financial plan that is perfect for someone 50 years old may not be appropriate for someone 30 years old. Every person has different financial needs and wants. Your financial plan will show how you live your life.

Financial Plan allows you to be totally honest about money. This will help you become a disciplined investor and correct your mistakes.

5. Financial planning is not about selecting the right financial product

A financial planner can help you gain more clarity about your financial life. Financial planner will help you find the right direction for your financial journey.

Your Financial Planner can help you make regret-free investments. Clients have regretted investing in ULIPS or regretting buying a second home when they realized they didn't have enough liquidity. If you work with a professional financial advisor to plan your finances, these regrets won't be there.

Financial planning is not about selecting the best financial product. Financial planning is about finding the right solution to take you where you want to be (financial goals).

6. Do not place your sole focus on bringing about certainty

Financial planning isn't about bringing certainty to your life. Financial Planning is about helping you to build your financial muscles that can help you deal with all types of situations. A financial plan will help you gain more control over your finances and give you an outside perspective.

In short-term investments and trading, portfolio security is not possible. You can plan for the long-term, however. It's not about certainty. It is about consistency in taking each financial step at a given time. This is the key to ensuring a financial life that's comfortable for you and your family.

You may find that many of your plans don't turn out as you planned. This does not mean that you should stop planning. No matter what, you must continue to plan.

7. Your financial plan should be a commitment

Do not be one of the 80% who aren't committed to their financial goals and causing financial problems for their family.

You can be among the top 20% of financial professionals who are committed to achieving their financial goals and creating a solid financial life for their family.

The goal of your financial plan is to set your goal and find a way to reach it. It is not difficult to set goals and get a direction, but it will show how serious you are about achieving your goal. Focusing on your goal will allow you to focus and not be distracted by other things.

Make a commitment now to reach your financial goals.

For financial security and stability, contact us to learn more about our Holistic Financial Planning Process.

Subscribe To Our Newsletter

Subscribe to our newsletter to receive up to date news, ideas and resources to help to manage your investment and risks.